Space Investment Hits Record High in 2018

Breaking space news, the latest updates on rocket launches, skywatching events and more!

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Daily Newsletter

Breaking space news, the latest updates on rocket launches, skywatching events and more!

Once a month

Watch This Space

Sign up to our monthly entertainment newsletter to keep up with all our coverage of the latest sci-fi and space movies, tv shows, games and books.

Once a week

Night Sky This Week

Discover this week's must-see night sky events, moon phases, and stunning astrophotos. Sign up for our skywatching newsletter and explore the universe with us!

Twice a month

Strange New Words

Space.com's Sci-Fi Reader's Club. Read a sci-fi short story every month and join a virtual community of fellow science fiction fans!

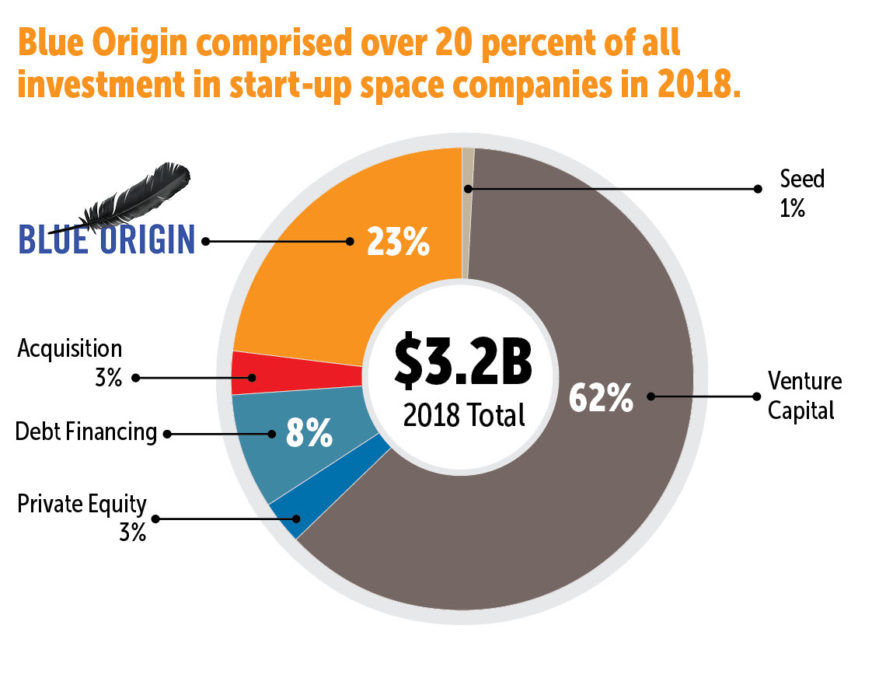

COLORADO SPRINGS — Investment into space companies hit a record high in 2018, exceeding $3 billion with no sign of an imminent downturn, according to a new report by a consulting firm.

The "Start-Up Space" report, published April 9 by Bryce Space and Technology, found that various types of investment into space companies, from venture capital to debt financing, totaled $3.23 billion in 2018. That tops the $3.03 billion invested in space companies in 2016, and $680 million more than in 2017.

That total came without a single deal larger than $1 billion. The Bryce report estimates the largest single deal last year was $750 million invested in Blue Origin by its founder, billionaire Jeff Bezos. There were also three separate late-stage investments in SpaceX that the report estimates to be worth more than $200 million each.

Related: Space Calendar 2019: Launches, Sky Events & More

"2018 was the biggest year yet, and it's really interesting because there were no billion-dollar deals," said Carissa Christensen, chief executive of Bryce, in an interview. "This was a lot of more diversified investment."

Venture capital investment alone grew by 22 percent in 2018 to $2 billion, she noted. "Those are the investors that are looking for financial return," she said, as opposed to those who invest for broader strategic reasons or have other non-financial motivations.

That growth is a positive sign for the industry, she said, because these investors are convinced by the business cases of these startups despite the limited number of companies in the sector that have provided a return to their investors. "There are a lot more VCs in the game, including many new investors to space," she said.

Breaking space news, the latest updates on rocket launches, skywatching events and more!

Another significant trend, she said, is the growth in the number of investors from outside the United States. While the majority of seed and venture funding in 2018 came from American investors, nearly half of the investors are from outside the United States, led by Britain and China.

The was little in the way of acquisitions of space companies in 2018. The Bryce report found eight such acquisitions with a total value of roughly $100 million. The lack of such deals, or other exits for investors, have led some to worry that the space industry is in a bubble that could burst in the near future, drying up investment.

Christensen said current investors are far more risk tolerant than those of two decades ago who stopped investing in the industry after companies like Globalstar and Iridium filed for bankruptcy protection, wiping out their stakes.

"The risk now is similar to the risk that Iridium faced" in terms of market uncertainty around new markets, she said. "But the investors now are aligned with that risk, whereas the corporate and equity investors in Iridium were not."

Current investors, she believes, won't panic when startups inevitably fail. "When we start seeing failures, which we will, the venture and the advocacy-oriented billionaire ecosystem will not react in the same way," she said.

The Bryce report, while not giving specific estimates for projected investment in 2019, concluded that investment will continue to grow in 2019, driven in large part by the development of so-called megaconstellations of broadband satellites by companies like OneWeb, SpaceX and Telesat. OneWeb announced March 18 it closed a $1.25 billion funding round, increasing the total it has raised to date to $3.4 billion.

Recent reports that Amazon is planning its own satellite constellation may also drive investment. "Those business cases are not yet proven," she said of megaconstellations, "but you look at them through a different lens when a company like Amazon enters the playing field."

- Read SpaceNews for the Latest Space Industry News

- Incredible Spaceflight Technology

- A Decade of Commercial Space Travel — What's Next?

This story was provided by SpaceNews, dedicated to covering all aspects of the space industry.

Jeff Foust is a Senior Staff Writer at SpaceNews, a space industry news magazine and website, where he writes about space policy, commercial spaceflight and other aerospace industry topics. Jeff has a Ph.D. in planetary sciences from the Massachusetts Institute of Technology and earned a bachelor's degree in geophysics and planetary science from the California Institute of Technology. You can see Jeff's latest projects by following him on Twitter.