News

Latest News

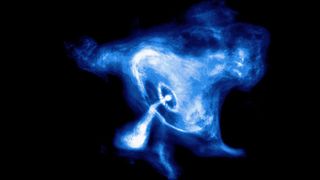

Watch 2 gorgeous supernova remnants evolve over 20 years (timelapse video)

By Stefanie Waldek published

These supernova remnants are moving at extraordinary speeds only visible to us in long-term timelapses.

Boeing Starliner 1st astronaut flight: Live updates

By Elizabeth Howell, Tariq Malik published

Boeing will launch its first-ever Starliner astronaut mission for NASA as early as May 6, 2024

US Space Force picks Rocket Lab for 2025 Victus Haze space domain awareness mission

By Meredith Garofalo published

A recent $32 million contract between the U.S. Space Force and Rocket Lab will lead to the creation of a spacecraft to enhance national security supporting space domain awareness.

Exploding stars send out powerful bursts of energy − I'm leading a citizen scientist project to classify and learn about these bright flashes

By Amy Lien published

Swift is a multiwavelength space telescope that scientists are using to find out more about these mysterious gamma-ray flashes from the universe.

Wow! Private space-junk probe snaps historic photo of discarded rocket in orbit

By Mike Wall published

The private ADRAS-J probe snapped an epic, up-close image of its rendezvous target, a Japanese rocket stage that's been circling Earth since 2009.

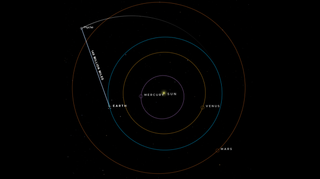

Laser on NASA's Psyche asteroid probe beams data from 140 million miles away

By Monisha Ravisetti published

NASA's DSOC experiment passed yet another milestone, interfacing with the Psyche spacecraft and beaming data back to Earth from 140 million miles away.

Lego Star Wars deals 2024: Top discounts on top sets

By Ian Stokes last updated

Deals Looking for the best Lego Star Wars deals you are? Find them here you will.

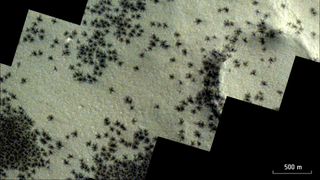

Satellites spot clusters of 'spiders' sprawled across Mars' Inca City (photo)

By Samantha Mathewson published

Seasonal spider-like features were spotted sprouting up through surface cracks near Mars’ Inca City region.

Early Star Wars Day Lego deal: $130 off UCS Razor Crest

By Alexander Cox published

Deals This is the way to celebrate Star Wars Day in style, with the 6187-piece Lego Ultimate Collector Series Razor Crest, now $130 off

NASA begins delivering 1st Artemis Moon Trees to be planted across United States

By Robert Z. Pearlman published

The first woman slated to launch to the moon has delivered one of the first trees grown from seeds recently flown there. NASA astronaut Christina Koch presented an "Artemis 1 Moon Tree."

Get the Space.com Newsletter

Breaking space news, the latest updates on rocket launches, skywatching events and more!